After the Gold Rush

Matt Greer

You’ve probably noticed the headlines. Gold and silver have had a remarkable run over the past two years, reaching record highs and generating dramatic gains. The financial media can’t stop talking about commodities.

It’s natural to wonder if we should have owned more of this. Are we missing out?

We understand the frustration. Watching an asset class surge while you’re not heavily invested is uncomfortable. Commodities feel tangible and real in a way that shares in a global portfolio may not. Additionally, gold has been a store of value for thousands of years and, until a few decades ago, underpinned global currencies. The narrative is simple and compelling: uncertainty is rising, so own something you can hold and touch.

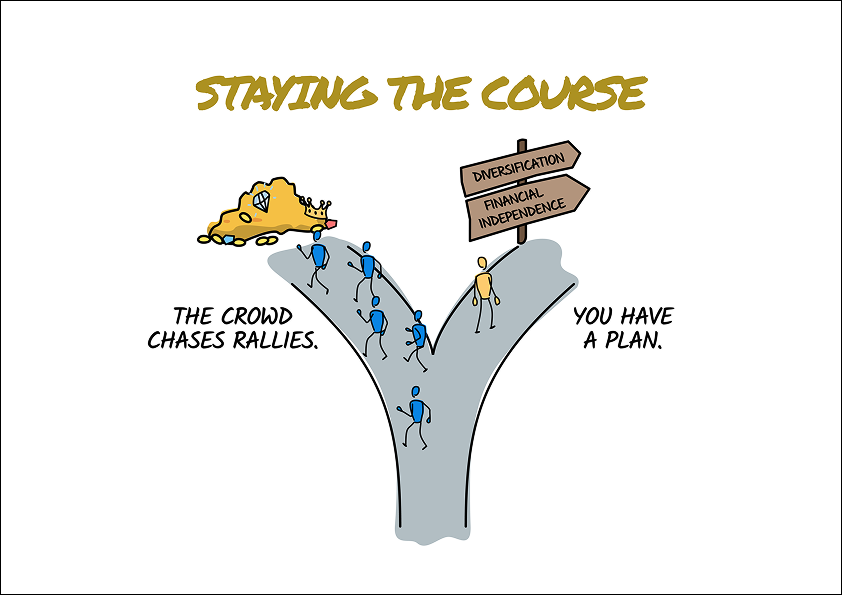

But before considering any changes, let’s think about what would have been required to capture these gains and why chasing recent winners rarely ends well.

The Hindsight Trap

Our brains play tricks on us after the fact. Psychologists call it hindsight bias, our tendency to believe past events were predictable all along. But uncertainty cuts both ways. For every asset class that surges, others disappoint.

To have made significant money from gold and silver, you would have needed to make a large, concentrated bet before the rally began. In early 2024, the case for a massive allocation wasn’t obvious at all. Gold was trading sideways. Interest rates were high. Silver had been bobbing along a range for years.

There’s another bias at work, called survivorship bias. We hear endlessly about the investments that worked out. The big bets that went wrong? They don’t make the news. The investors who loaded up on the last decade’s “sure thing” and lost aren’t writing articles about it.

Hindsight makes winners look inevitable, but they never are.

Why Diversification Still Wins

There’s a fundamental difference between owning commodities and owning businesses.

Gold and silver have real-world uses. They go into jewellery, electronics, and various other industries. But as financial assets, they produce no income. No earnings. No dividends. They just sit there. In fact, they cost money to store and insure.

Equities represent ownership in companies that create products, serve customers, and generate profits. We don’t know what challenges the next decade will bring, but we’re confident that human ingenuity will rise to meet them. These businesses adapt, innovate, and find a way.

Gold’s role is less certain. Will it still be the go-to inflation hedge in twenty years? The preferred safe haven when markets fall? These narratives shift, as we have seen with the emergence of Bitcoin and other digital assets. At the end of 2018, after four years of negative returns over a period of six years, gold was an afterthought. Today it’s back in favour. Tomorrow? We don’t know.

What we do know is that businesses will keep solving problems and serving customers. That’s what you own in a diversified portfolio.

Lastly, if you own a diversified global portfolio, you didn’t miss the gold rally entirely. Global equity funds hold gold miners and many commodities companies. Your diversified portfolio captured some of the gains, just not through a speculative bet that could have gone the other way.

Process Over Outcomes

Everything we do is about protecting your family’s financial fortress and helping you remain financially independent for the rest of your life. Speculative positions, no matter how well they performed this year, don’t fit that picture.

Sound financial planning isn’t about guessing which asset will perform best next. It’s about building portfolios robust enough to meet your goals across a range of outcomes. Portfolios designed for decades, not days and not news cycles.

The next hot asset class will eventually cool. Another will take its place in the headlines.

Through it all, our approach remains the same: stay diversified, stay disciplined, and trust the process. If you’d like to discuss your portfolio, we’re always here to help.

Newsletter

Sign up today to be the first to receive our content, straight in your email inbox.

Our reputation

I have peace of mind that we are on track to achieving what we want out of life. I feel we have our finances in order now and we are really making the most of what we have.

Ian & Nicola – Deputy CEO and Designer

The process gave us tremendous peace of mind - knowing we have financial security and that any necessary advice and decisions are taken with the help of a professional.

Robert & Pauline, retired

Through the use of cashflow planning I have been able to get a greater handle on my income and expenditure and Paul is able to show me that I am on track to achieving my goals

Louise, Cosmetic Dentist

We meet twice a year, but Darren is always on hand should I have any “financial ideas”, queries or problems. If it is not in his expertise, he has no hesitation in bringing in one of his considerably gifted team.

Gareth and Heather, run a successful fashion business

It is great to have an expert look after my finances and it gives me peace of mind to know that my retirement fund is being well looked after

Terry, Golf course manager

We have been very impressed with Michael’s honest and personable approach to dealing with our finances and he has always gone out of his way to make sure we were happy.

Vincent and Mary O’Connell, run a successful furniture business