Financial Tips: For Business owners and Company Directors

Matt Greer

This short blog post is designed to help business owners and company directors make their money work harder for them.

In my experience, these clients are very busy running their businesses and don’t often have time to sit and think about planning for the future.

So, with that in mind, I want to keep this post as clear and concise as possible and help give you 3 tips to help your hard-earned profits work harder.

Tip 1 – Free Pension Money

Employer pension contributions are an allowance expense meaning they reduce your company’s corporation tax bill. You can

extract profits out of your company and put them into your pension and pay no income tax or corporation tax on these contributions. Then once in your pension, the money can be invested and grow tax-free.

I appreciate that when you are running a busy business pensions can be the last thing on your mind but when you think about what a pension is, and the huge benefits on offer, it becomes massively important. A pension is just a pot of money that provides you with an income after you’re done working for a living.

While that may seem a long way away, there will come a time when you don’t want to work any longer and when that day comes you will wish that you saved into a pension sooner.

Say you were to take £100 out of the business as a higher rate taxpayer you would receive just £54 after corporation tax and dividend tax. By comparison, you could put that whole £100 into the pension and receive the whole lot when you retire. That’s an uplift of 85%!

It’s free money and if you aren’t taking advantage of it, you are missing out big time.

Tip 2 – Insurance as a Business Expense

Another big way to make your money work harder as a business owner is to take life insurance out through the company.

This is because, like pension contributions, insurance premiums are an allowable expense for corporation tax.

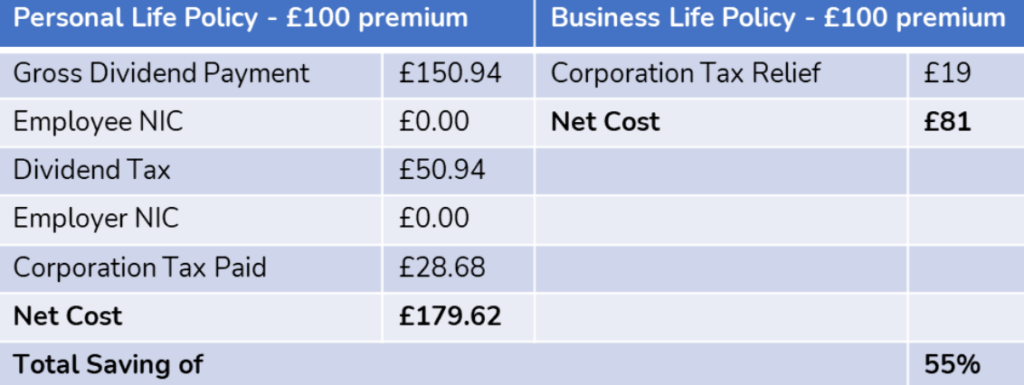

If you already have life insurance of say £100 per month and are paying this from your personal bank account you will have had to extract that £100 net from your business.

If you are a higher rate taxpayer then it would cost around £179 to get £100 net when factoring in dividend tax and corporation tax.

If the business were to pay the £100 per month then you would receive corporation tax relief of £19 meaning that you only pay £81 for £100 worth of premiums and have a total saving of 55%.

If you don’t have life insurance then you can see above the benefit of taking it out through the business and getting more for your money.

Tip 3 – Pay Less Tax

The final tip is to Pay Less Tax. this may sound simple but one of the biggest benefits of being a business owner is that you can control how you withdraw your income.

Let’s say you earn £100,000 per year. As an employee, you will have to pay taxes and national insurance of around £34,000 leaving you with just £66,000 net.

However, as a business owner, earning the same amount will provide you with an income of £80,000 if structured properly. That is an increase of £14,000 per year in your pocket.

Simple planning opportunities like withdrawing the right mix of dividends to salary can make huge differences. Even with those

clients who use accountants, I still come across business owners who are paying far more tax than they need to.

Summary

If you are a business owner or company director and you are not taking advantage of the above then you have to ask yourself, why not? These are ways that you can make the most of your hard-earned profits by way of saving for the future (pension), protecting yourself and your family should the worst happen (insurance) and paying no more tax than you have to (paying less tax).

If you would like to talk about any of the above, I work with business owners every week to help plan for the future and would love to have a chat to see if I could help you too.

Matt

Newsletter

Sign up today to be the first to receive our content, straight in your email inbox.

Our reputation

I have peace of mind that we are on track to achieving what we want out of life. I feel we have our finances in order now and we are really making the most of what we have.

Ian & Nicola – Deputy CEO and Designer

The process gave us tremendous peace of mind - knowing we have financial security and that any necessary advice and decisions are taken with the help of a professional.

Robert & Pauline, retired

Through the use of cashflow planning I have been able to get a greater handle on my income and expenditure and Paul is able to show me that I am on track to achieving my goals

Louise, Cosmetic Dentist

We meet twice a year, but Darren is always on hand should I have any “financial ideas”, queries or problems. If it is not in his expertise, he has no hesitation in bringing in one of his considerably gifted team.

Gareth and Heather, run a successful fashion business

It is great to have an expert look after my finances and it gives me peace of mind to know that my retirement fund is being well looked after

Terry, Golf course manager

We have been very impressed with Michael’s honest and personable approach to dealing with our finances and he has always gone out of his way to make sure we were happy.

Vincent and Mary O’Connell, run a successful furniture business